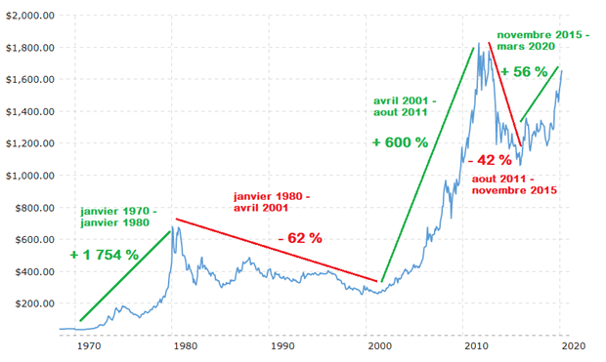

Gold from 1970

During the 1970s, there was stagflation: the economy had weak (stagnant) growth and there was inflation, especially with the two oil shocks.

Investors, including private individuals, will then invest massively in gold, which is considered a safe haven. Gold is growing faster than prices, which protects its capital and allows it to accumulate capital gains.

The price rises from $35 per ounce to $678, a nearly 19-fold increase.

Between 1980 and the early 2000s

Starting in the 1980s, growth regains strength and inflation falls, with investors preferring riskier assets (stocks and bonds) that provide a better return. Gold appears less of a safe haven and a preferred investment.

This was a very low period for gold, its price fetl sharply in the early 1980s (-62%) and thenfluctuated for 20 years between $300 and $400.

There is no significant rise or fall in the price of gold, those who invested did not lose money but neither did they gain money.

The price of gold after the 2000s

With the subprime financial crisis in 2007/2008 central banks are injecting massive liquidity into the economy and until 2011 gold will again rise to a peak of $ 1950.

Between 2011 and 2018, once the subprime and European debt crisis has been resolved, investors once again abandoned gold, which declined slightly and remained stable between $1,200 and $1,400.

Since 2019, concern is growing about the amount of public and private debt, and investors are once again turning to gold as a safe haven.

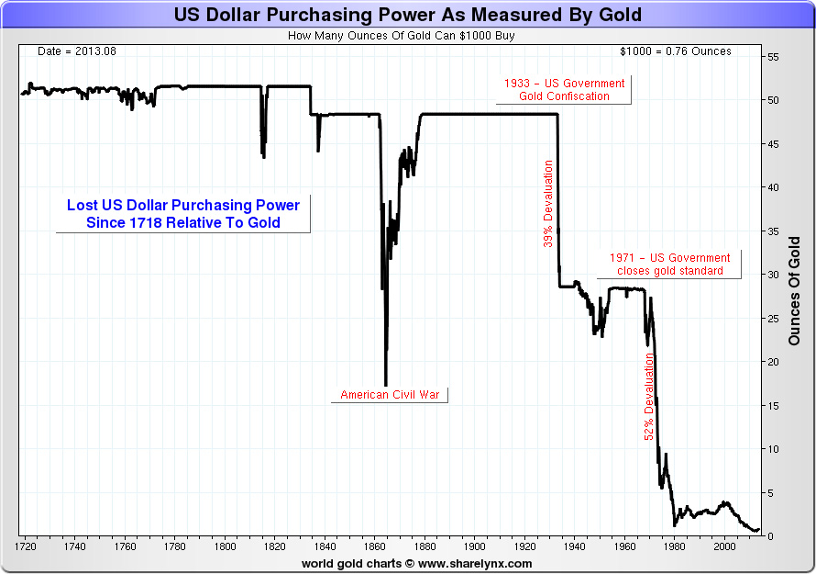

The purchasing power of gold today

In 1720, $1,000 allowed the purchase of more than 50 ounces of gold, whereas to this day the same $1,000 only buys about 0.76 ounces of gold.

The purchasing power of gold makes no reference to its price or rate. It refers to the quantity of goods that can be purchased with, for example, an ounce of gold.

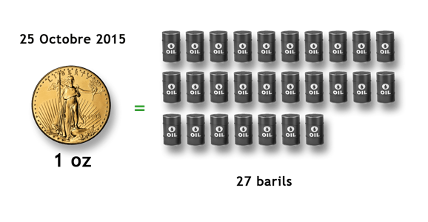

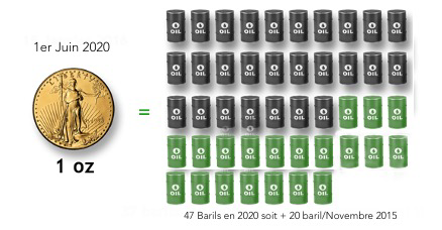

For example, in November 2015, 1 ounce of gold could buy 27 barrels of oil. By June 1, 2020, that same ounce of gold could buy 47 barrels.

Why is the price of gold doomed to rise?

Gold was the first metal known to primitive mankind and has been the ultimate currency for several millennia.

With an ounce of gold you can buy almost the same amount of basic goods today as in the days of the Roman Empire or Egyptian civilization.

Gold is one of the most processed raw materials. Trade is worth more than $4 trillion a year.

So anything's possible in the short term:

- Temporary sharp rise to counter major stock market declines, stagnation or slow decline if the dollar continues to appreciate and oil continues to fall.

In the long run only one possibility:

- The value of gold can only increase.

The clues:

- Supply from mines is far below final demand. Gold mining companies closed the most difficult mines to improve their profitability.

- World gold production is stagnating. Since it takes 7 to 10 years to develop new mine, during this period demand will outstrip supply.

- Peak production has already been reached: it was in 2001, with just over 2,500 tonnes extracted.

- Since 2004, banks have concluded the Washington agreements to regulate and limit sales of central bank gold reserves. A massive influx of gold from central banks is therefore not to be expected.

- The recent crises in the United States have made savers aware that dynamic money market investments are risky. This triggered a reflex to buy gold.

- As gold is quoted in dollars, a fall in the dollar due to massive monetary printingsleads to a mechanical rise in the price of the precious metal.