Guaranteed coupon of 5% for the first 2 years

Guaranteed Capital

Repayment possible in the third year if interest rates fall

Why secure your investments?

With financial markets reaching record levels andeconomic uncertainty persisting, it's crucial to take stepsto secure your investments.

Stock market rises can be seductive, but they can also signal overvaluation, increasing the risk of major corrections. By diversifying your portfolio towards less volatile assets, such as government bonds or capital-guaranteed investments, you can reduce your exposure to market fluctuations.

What's more, signs of a global economic slowdown underline theimportance of protecting capital against future shocks. It therefore makes sense to re-evaluate one's investment strategy and adopt a more cautious approach in the face of growing market uncertainty.

What is the advantage of the Rendement Stratégie baisse de taux investment?

Discover a secure investment offering an attractive return of 5% per annum, while guaranteeing the safety of your capital. With this option, you benefit from a perfect balance between yield and peace of mind. Take advantage of a stable, reliable investment to grow your moneywithout taking unnecessary risks.

How does it work?

- You invest in a capital-guaranteed "yield strategy rate cut" investment available in a securities account or a French or Luxembourg life insurance policy.

- For the first 2 years, you receive a guaranteed coupon of 5%.

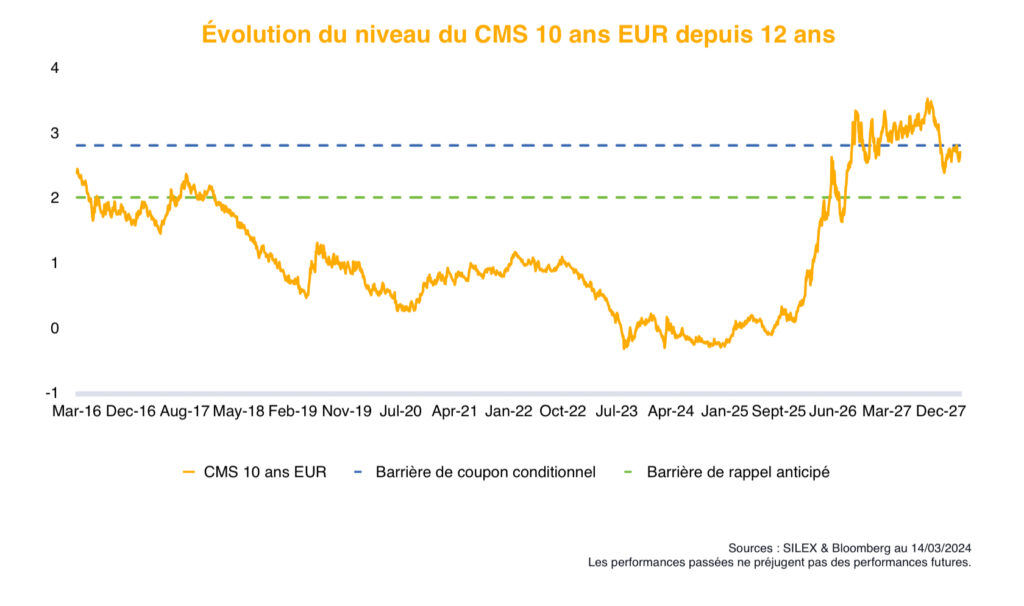

- Each year, starting in the third year, if the CMS 10-year rate has fallen by 0.6%, the investment is repaid and you receive your capital and a final coupon of 5%.

- If the 10-year CMS rate has not fallen by 0.6%, a 5% coupon is paid as long as the 10-year CMS rate remains below 2.8%.

- Capital is guaranteed at maturity.

- During its lifetime , your investment fluctuates slightly according to the inverse of the 10-year CMS rate: your investment increases in value if the 10-year CMS rate falls, and decreases in value if the rate rises.

- You can withdraw your investment at any time at its market value on the day of the withdrawal request.

What are the risks and benefits?

Risks

- In the event of resale before maturity and in the absence of early redemption, you may suffer a capital loss if the CMS 10-year rate has risen.

- From the third year onwards, the 5% coupon is distributed only if the CMS 10-year rate remains below 2.80%.

- Capital is guaranteed on condition that the bank does not file for bankruptcy

Benefits

- Capital guaranteed at maturity

- Guaranteed coupon of 5% in years 1 and 2

- Redemption possible from year 3 if the 10-year CMS rate falls by 0.60% with a final coupon of 5%.

Who is this type of investment for?

This investment is aimed at all investors wishing to secure their investments and obtain a guaranteed return of 5% for 2 years.Assuming a 0.60%fall in the 10-year CMS rate, which is currently the central scenario, the investment would be redeemed after 3 years with a final coupon of 5%.

This investment will allow us to get through the next 2 to 3 years with complete peace of mind, in a very turbulent geopolitical and economic climate.

The minimum investment is €100,000 for a French life insurance policy or securities account, or €250,000 for a Luxembourg life insurance policy.