A 30% flat tax

The Single Flat Tax (SFT), better known as 'flat tax', replaces the progressive tax scale. This levy includes taxes up to 12.8% and social contributions for 17.2%.

All financial income currently taxable at the progressive scale can opt for this flat tax: interest on bankbooks (excluding Livret A, LDD, Livret jeune and LEP, etc.), bonds, didivdendes and capital gains on securities.

PELs taxed from January 1st, an opportunity?

PELs previously exempt from levies for the first 12 years will be taxed from the first year for all PELs opened from 1 January 2018.

An opportunity? Not really, when you know that the PEL rate is currently 1% excluding the state premium. As for the right to loan at 2.20%, this is more expensive than the rates you can get in banks (about 1.5% over 15 years), in short, go your way.

Increase in CSG

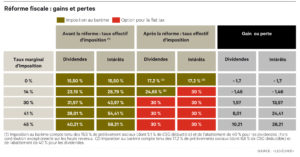

Flat tax being on option, it remains possible to tax one's financial income according to the progressive scale in these cases one must also pay the CSG, the rate of which increases by 1.7%.

Apart from dividends, as soon as you become taxable for income tax purposes, you should opt for flat tax, and from the 14% bracket for those with dividends.

Winners and losers

The vast majority of savers will be winners with the introduction of the Flat Tax. The gain naturally increases with the marginal tax bracket.